Calculate depreciation expense for rental property

Calculating MACRS depreciation can be complicated. Did not exist prior to 1999.

How To Use Rental Property Depreciation To Your Advantage

Cost of asset salvage valueestimated useful life annual depreciation expense 600 1005.

. This type of. This illustrates tables 2-2 a through 2-2 d of the percentages used to calculate the depreciation amounts on 5- 7- and 15-year property and residential rental property 275-year as described in the text. The deduction to recover the cost of your rental propertydepreciationis taken over a.

Bonus depreciation property that is qualified property under 168k property eligible for the special depreciation allowance. Residential rental property is depreciated at a rate of 3636 each. Rental property sold for 134400 including selling expenses.

All the cost of the second line is. Cost basis for capital gains on a rental property sale. For commercial buildings the term is 39 years.

Calculate total depreciation expense. Depreciation on Rental Property When you purchase a rental home or make improvements to it the IRS lets you depreciate the expense over the entire useful life of that property. Federal income tax return.

4734 annual depreciation expense x 5 years 23670 total depreciation to recapture. More specifically MACRS enables businesses to calculate the depreciation expense the percentage of assets the business can write off throughout its useful life. The depreciation rate can also be calculated as the reciprocal of the useful life Useful Life Useful life is the estimated time period for which the asset is expected to be functional and can be.

Will I owe depreciation recapture on rental property if its gifted. During the 10-year ownership period. IRS Publication 946 Appendix A includes three different tables used to calculate a MACRS depreciation deduction.

How to Calculate Depreciation on a Rental Property By Cathie Ericson. The reason is that the methods applied to calculate depreciation expense for accounting and tax purposes do not always coincide. At the time of sale.

Depreciation interest on your home loan. Every year you expense some of their value to reflect aging and obsolescence. Depreciation is a term used to describe the reduction in the value of as asset over a number of years.

By convention most US. Normally when a rental property is sold the depreciation expense is recaptured. Rent expense management pertains to a physical asset such as real property and equipment.

The exception to this is residential rental property which has a recovery period of 275 years and nonresidential real property which has a recovery period of 39 years. To calculate the expenses that she can claim as a tax deduction Ava needs to apportion them according to the amount. Larger deduction over the propertys AMT class life.

As you can see the amount of equity in the property 5 years after purchase assuming a 30-year amortization schedule and 1 per year appreciation is 47898. The total annual expenses for the property amounted to 7200. Depreciation commences as soon as the property is placed in service or available to use as a rental.

When a rental property is sold the adjusted cost basis is used to calculate the profit on the sale and the capital gains tax. 23670 x 25 maximum tax rate 5918 tax paid on depreciation recapture. To calculate your depreciation divide your property value by 275 and you get the amount of depreciation youre allowed to claim each year.

A Depreciation Schedule is a table that shows the depreciation amount over the span of the assets life. Compare Comparable Sales prices Rental Income Capitalization Rates to determine the fair market values of your property. Assuming the rental property in this example generated a pre-tax income of 8000 an investor could deduct the total depreciation expenses of 6436 to reduce the amount of taxable income to 1564.

For accounting and tax purposes the depreciation expense is calculated and used to write-off the cost of purchasing high-value assets over time. A bonus depreciation is a tax incentive that allows a business to immediately deduct a large percentage of the purchase price of eligible business assets. Any business or rental property owner that claims depreciation expense on a US.

Who its for. Even if you lease equipment rather than buying it you may have to report depreciation of rental equipment as a business expense. Next determine the depreciation rate category based on the propertys natureIt would be either 5 10 or 100 which would be used to calculate the annual depreciation of the building.

As an owner of rental property your net worth would now be almost 48000 higher due to your investment decision. For example accounting depreciation is commonly determined using the straight-line method but tax depreciation is generally calculated via accumulated depreciation methods eg double declining method. 5636 800 6436.

City replaced water lines for an assessment of 4000 easement granted to the next-door neighbor for building their fence on your side of the property line 1000 total depreciation expense of 41090. Ava chose to have her rental property become her main residence after three years of using it to generate an income. Use the 150 declining balance method over the same life switching to straight line the first year it gives a larger deduction.

12 rental investment Reports Pre-built and professional investment reports that summarize your Rental Investment Analysis Results so you can create professional investment reports for your business partners lenders.

Depreciation For Rental Property How To Calculate

3 Ratios To Start Tracking Now Rental Property Calculator Accidental Rental

Rental Property Depreciation Rules Schedule Recapture

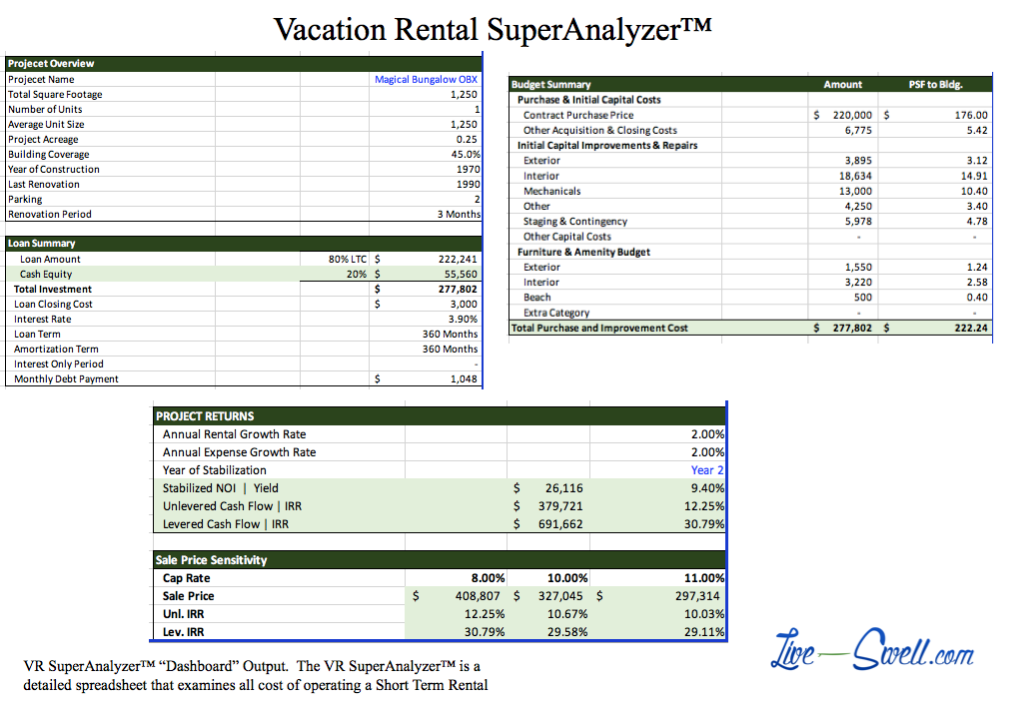

Vacation Rental Expenses Done Smart Easy Free Calculator Live Swell

Rental Property Cash On Cash Return Calculator Invest Four More

How To Calculate Depreciation On Rental Property

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

How To Depreciate A Rental Property Formula Excel Example Zilculator Real Estate Analysis Marketing

Depreciation For Rental Property How To Calculate

Renting My House While Living Abroad Us And Expat Taxes

How To Report The Sale Of A U S Rental Property Madan Ca

Straight Line Depreciation Calculator And Definition Retipster

How To Calculate Depreciation On A Rental Property

How To Report The Sale Of A U S Rental Property Madan Ca

How You Can Make Money From Your Rental Show A Loss On Your Tax Return Semi Retired Md

3 Ratios To Start Tracking Now Rental Property Calculator Accidental Rental

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips